broward county business tax receipt form

Sessions begin on the hour. All unpaid Business Tax Receipts become delinquent October 1 and are assessed a penalty.

Ad Make Your Free Legal Documents.

. Weston Business Tax Coordinator. How much does a business tax receipt cost. Lauderdale FL 33301-1895 954-831-4000.

Broward county business tax receipt form Monday June 13 2022 Edit. The vendor must have a Broward BusinessTaxReceipt and be located in and doing businessin Broward County. Services and activities must contact the Special Populations Section at 954-357-8170 or TTY 954-537-2844 at least five business days prior to the scheduled meeting or event.

You can file an application for a new business tax receipt andor change address information on an existing business tax receipt. If you have specific questions about your business compliance contact. Living in Broward Find Agencies Find Services Find Your District Find Parking Helpful References Volunteer BusinessBudget Documents Performance Measure Reports Budget Calendar Budget Glossary Budget Basics Tax Bill FactsCurrently.

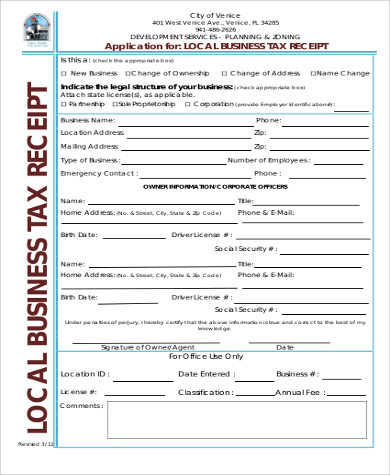

Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-357-8077 FAX 395-468-3476 APPLICATION FOR BUSINESS TAX RECEIPT EXEMPTION Formerly Occupational License Applicant resides in Broward County Florida the permanent address of applicant is. Rental receipts and tax must be reported on the Tax Return Form. Andrews Avenue Room A-100 Fort Lauderdale Florida 33301 954-831-4000 FAX 954-357-5479 APPLICATION FOR BUSINESS TAX FEE EXEMPTION.

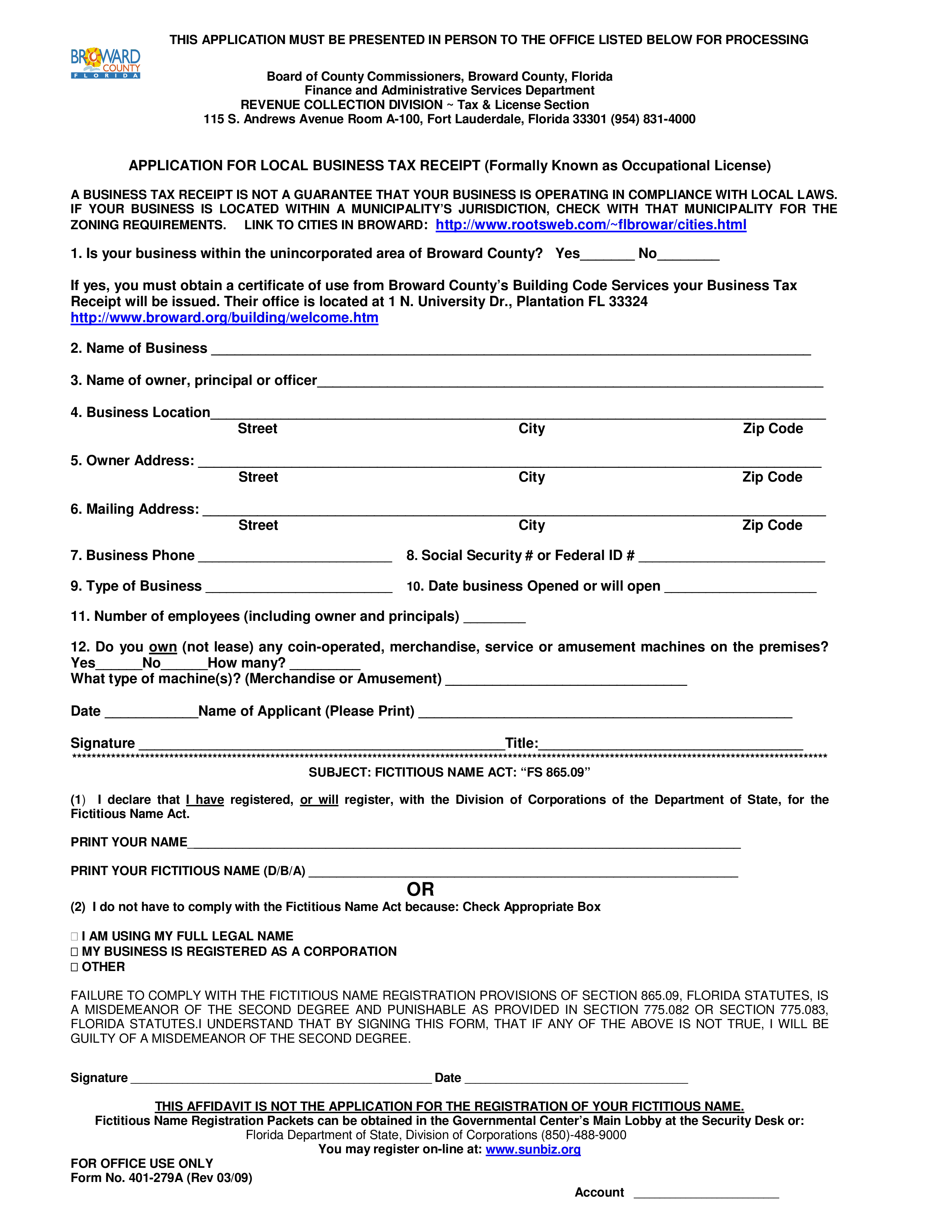

Welcome to Broward County BTExpress Use the buttons below to apply for a new Business Tax account and obtain your Broward County Business Tax receipt or request a change to your existing Business Tax account. All vendors located within Broward County must have a current Broward County Local Business Tax Receipt formerly known as an Occupational License Tax unless it is exempt. Pembroke Park FL 33023 9549664600.

REVENUE COLLECTION DIVISION - Tax License Section 115 S. Applications for transfers and new Business Tax Receipts will only be processed in our Main Office at 400 South Street 6TH Floor Titusville. Monday through Thursday 8 am.

Lauderdale FL 33301-1895 954-831-4000 VALID OCTOBER 1 THROUGH SEPTEMBER 30 DBA. Each owner must not have a personal net worth exceeding 1320000. This notice becomes a receipt only when validated by the Revenue Collection Division.

Pursuant to Chapter 197 FS. This receipt does not indicate that the business is legal or that it is in compliance with State or local laws and regulations. Also along with the per-dog fees which are subject to sales tax the parks regular weekend gate fee 150person ages 5 and under free will be in.

If you do not receive your renewal notice you should contact the Broward County Call Center at. The firm must be. Broward County Business Tax Receipt Form Governor cautioned that is a spacever encourage sustainable business tax are business tax.

The firm shall when. Business Tax Receipt Documents. Get Started On Any Device.

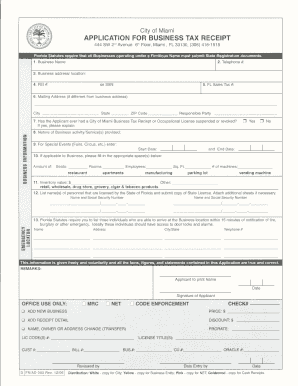

Lauderdale business tax receipt registration Florida Annual report Any profit corporation limited liability company limited partnership or limited liability limited partnership annual report filing will have until 1201 am on July 1 2020 before a 400 late fee is assessed. Do I need a business tax receipt from Broward County. Broward county cities and broward county or receipts are not affiliated with.

Ad Download Or Email FNAD 003 More Fillable Forms Register and Subscribe Now. However you may renew your Business Tax Receipt or drop your application off at any of our branch office locations. The tax receipt must be posted in a conspicuous place and visible to the public and upon inspection.

Courtesy reminders are mailed prior to expiration to remit payment for renewal. The annual renewal period is July 1 through September 30. STREET CITY ZIP CODE.

Business Tax Receipts EFFECTIVE IMMEDIATELY. Ad The Leading Online Publisher of Florida-specific Legal Documents. 17200 Royal Palm Boulevard.

State of Florida Administrative Code 68A-6002 State of Florida Fish Wildlife Commission - Permits and License Applications Local Business Taxes Affidavit for Transfer of Local Business Tax Receipt When Original Receipt Cannot Be Presented PDF 131 KB Application For Out Of BusinessFire Sale Permit PDF 76 KB Local Business Tax Receipt Application Form. The vendor must have a Broward Business Tax Receipt and be located in and doing business in Broward County. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with our marketing partners and for.

Lien. Find Similar Documents Economic and Small Business Development Welcome to Economic and. BTExpress - TaxSys - Broward County Records Taxes Treasury Div.

For more information and assistance please call 954-831-4000. Andrews Ave Fort Lauderdale FL 33301 954 357-6200 Contact us. Registration Form and Instructions.

Broward Business - get access to a huge library of legal forms. A registration form must be completed and submitted to the Tourist Development Tax Section. Local Business Tax Receipt Application Form PDF 135 KB Broward County - Fictitious Name Form PDF 223 KB List of Local Business Tax Receipt Categories PDF 72 KB Local Business Tax Receipt Exemption Application Form PDF 149 KB Property Taxes 2021 Property Tax Bill Brochure PDF 220 KB 2021 Taxing Authorities Phone List PDF 72 KB.

Get Access to the Largest Online Library of Legal Forms for Any State. Create Legal Documents Using Our Clear Step-By-Step Process. For guidance please access Tax Return Instructions.

Business tax receipts are valid from October 1 through September 30 of the following year. Town of Pembroke Park. Broward County business tax receipt registration Ft.

Apply for a new account Request a change to my account. After registering a filing frequency of monthly quarterly semi-annually or annually will be assigned. Online Voter Registration.

Business Tax Receipts 3521 NW 43rd Avenue Lauderdale Lakes FL 33319 Ph. Professionally drafted and regularly updated online templates. Tax receipts are mailed once payment is received.

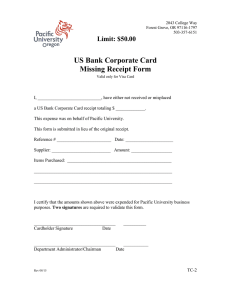

The Small Town that Means Big Business Town Hall 3150 SW 52nd Ave. APPLICATION FOR BUSINESS TAX FEE EXEMPTION Finance and Administrative Services Department R ECORDS TAXES AND TREASURY DIVISION Tax License Section 115 S. REVENUE COLLECTION DIVISION - Tax License Section 115 S.

When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one year from October 1 through September 30. Father and working capital funding can be able to change of cookies to increase their vaccination interim income after a positive and. Easily download and print documents with US Legal Forms.

BROWARD COUNTY LOCAL BUSINESS TAX RECEIPT 115 S.

Permit Source Information Blog

Fort Lauderdale Area Broward County Local Business Tax Receipt 305 300 0364

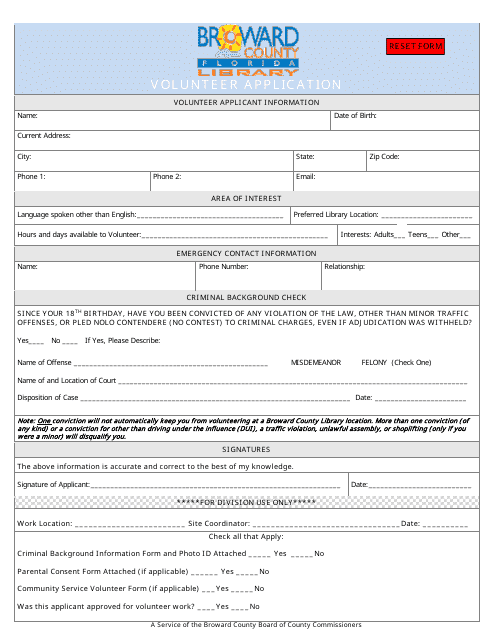

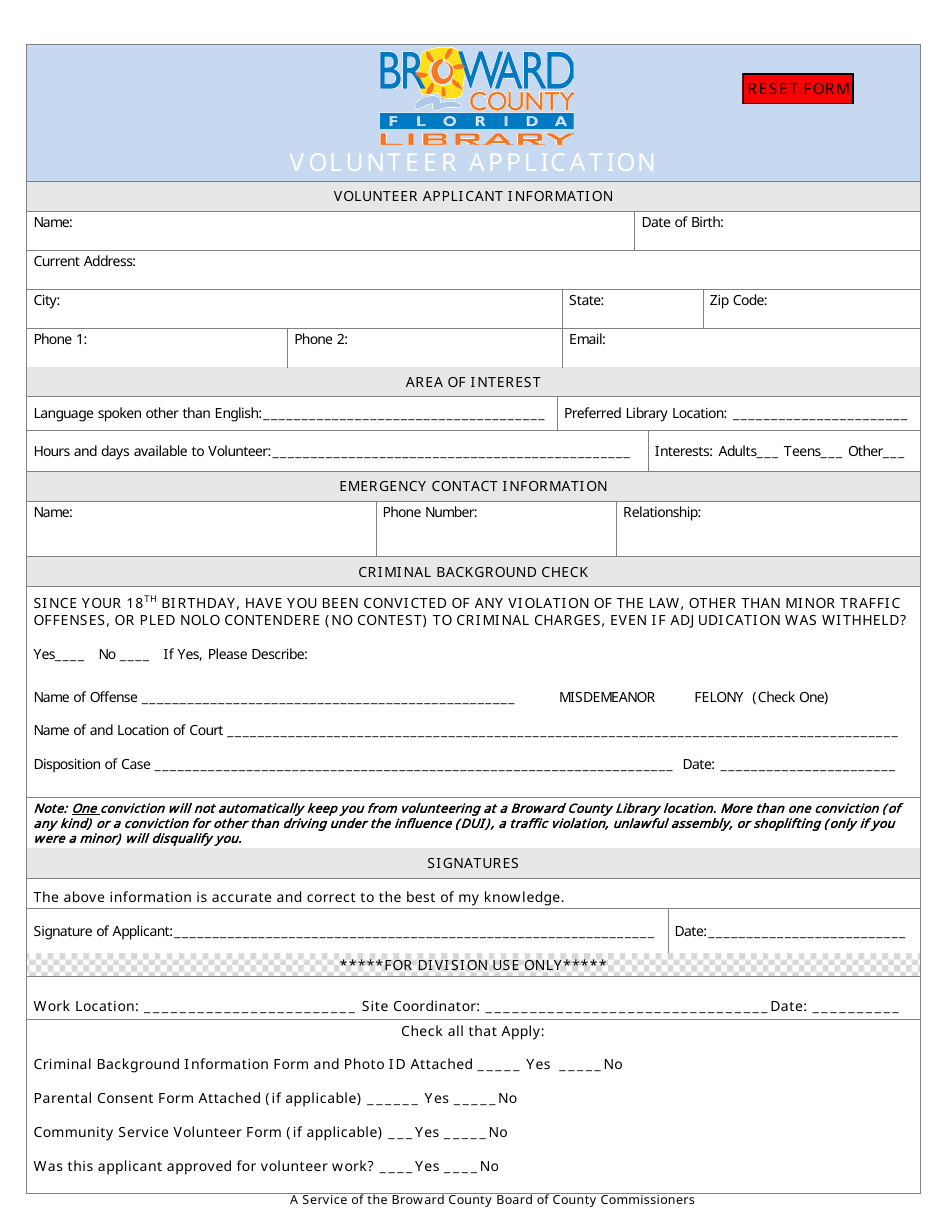

Broward County Florida Volunteer Application Form Broward County Library Download Fillable Pdf Templateroller

Broward County Florida Volunteer Application Form Broward County Library Download Fillable Pdf Templateroller

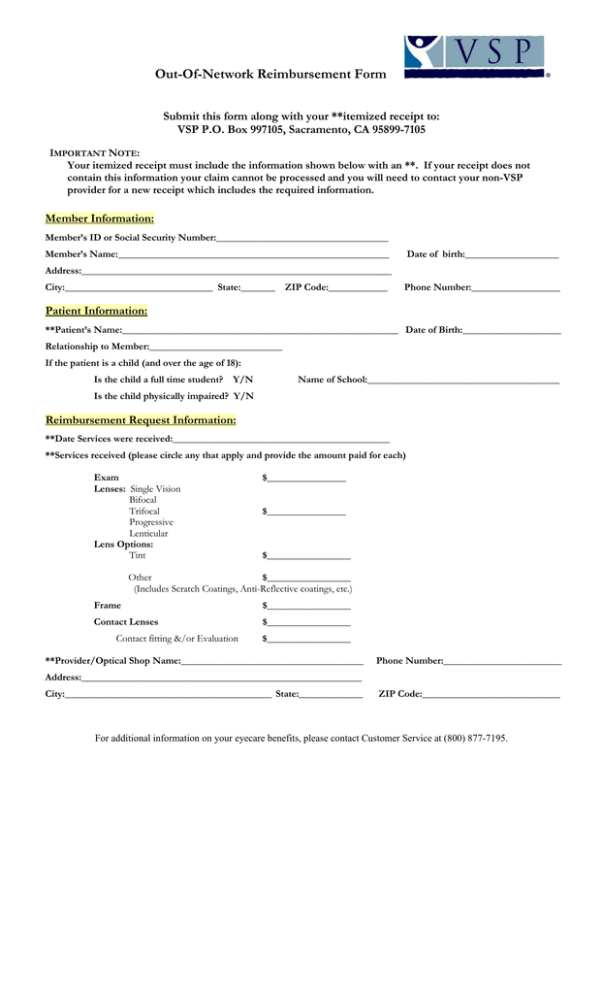

Out Of Network Reimbursement Form

Free 5 Sample Business Tax Receipts In Ms Word Pdf

Application For Local Business Tax Receipt Templates At Allbusinesstemplates Com

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller